Trade Manager: The Essential Trading Tool for Every Trader

A trade manager in forex trading is a tool or system that helps traders to manage their trades more effectively. Trade manager can be manual or automated. Manual trade managers require the trader to input all of the necessary information, such as the trade size, entry and exit levels, and stop-loss and take-profit orders. Automated trade managers can automatically execute trades and manage them based on pre-set rules.

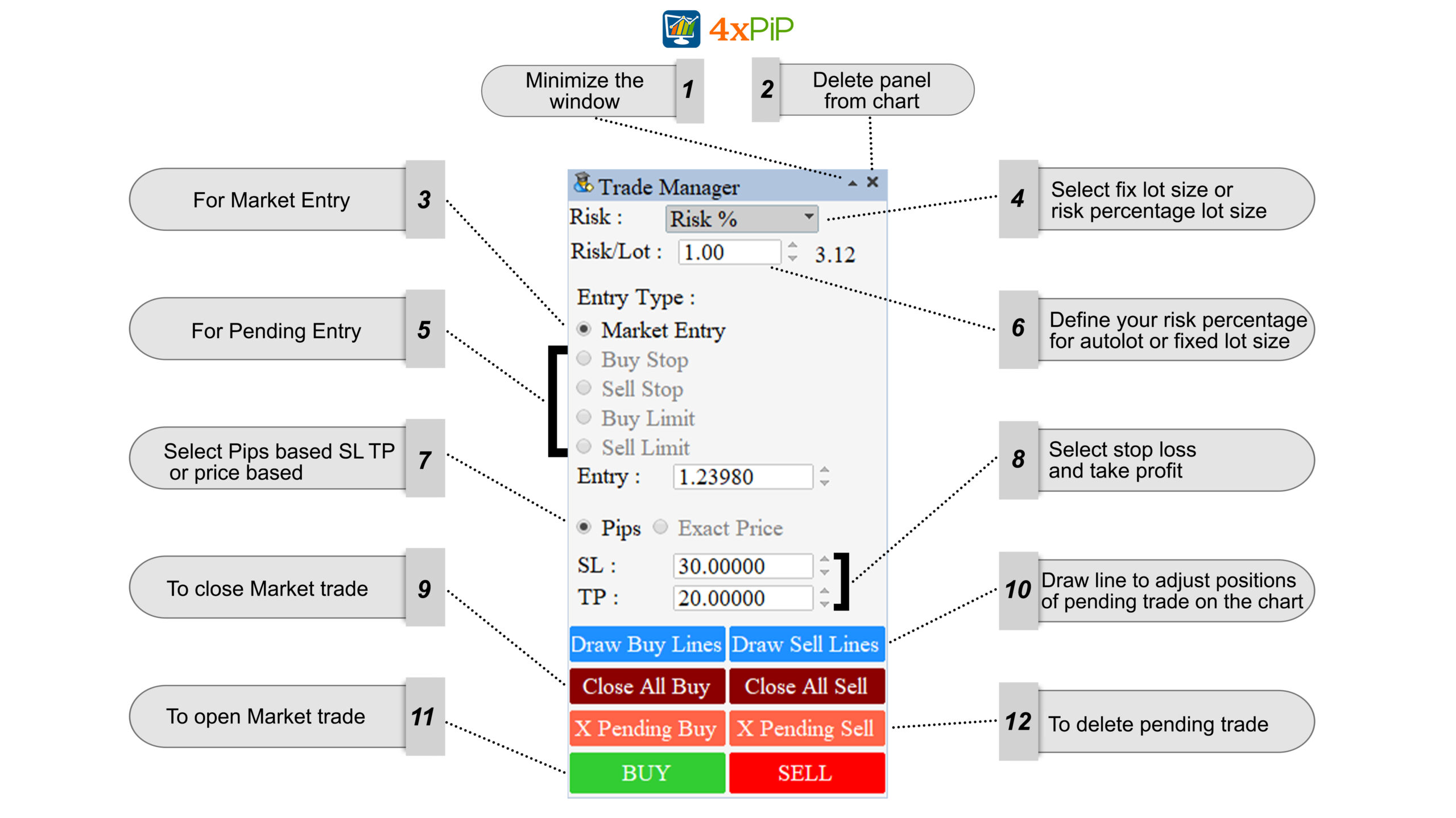

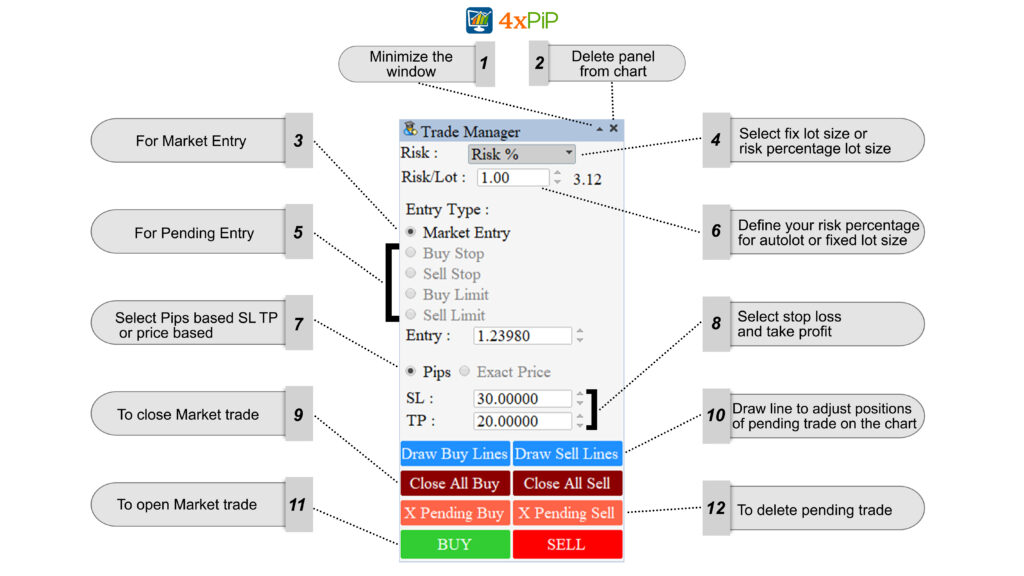

Here’s a breakdown of what a Trade Manager typically does and how it’s defined:

1. Order and Position Management: A Trade Manager allows traders to monitor and manage their open orders and positions in real-time. It provides a comprehensive view of all active trades, including entry prices, stop-loss levels, take-profit levels, and current profit or loss.

2. Risk Management: It helps traders implement risk management strategies by calculating position sizes based on predefined risk parameters. This ensures that each trade’s position size is appropriate for the trader’s risk tolerance and account size.

3. Trailing Stop Orders: Many Trade Managers offer trailing stop functionality, allowing traders to automatically adjust their stop-loss orders as the market moves in their favor. This helps lock in profits while still giving room for the trade to run.

4. Scale-In and Scale-Out: Some Trade Managers enable traders to scale into or out of positions. This means adding to or reducing the position size as the trade progresses and market conditions change.

5. Trade Automation: Trade Managers can automate certain actions, such as closing a portion of a trade when a specific profit target is reached or moving stop-loss levels to break-even after a certain profit threshold is achieved.

6. Trade Analysis: Trade Managers often provide trade analysis tools, including performance metrics, trade history, and statistics. This helps traders assess the effectiveness of their trading strategies and make data-driven decisions.

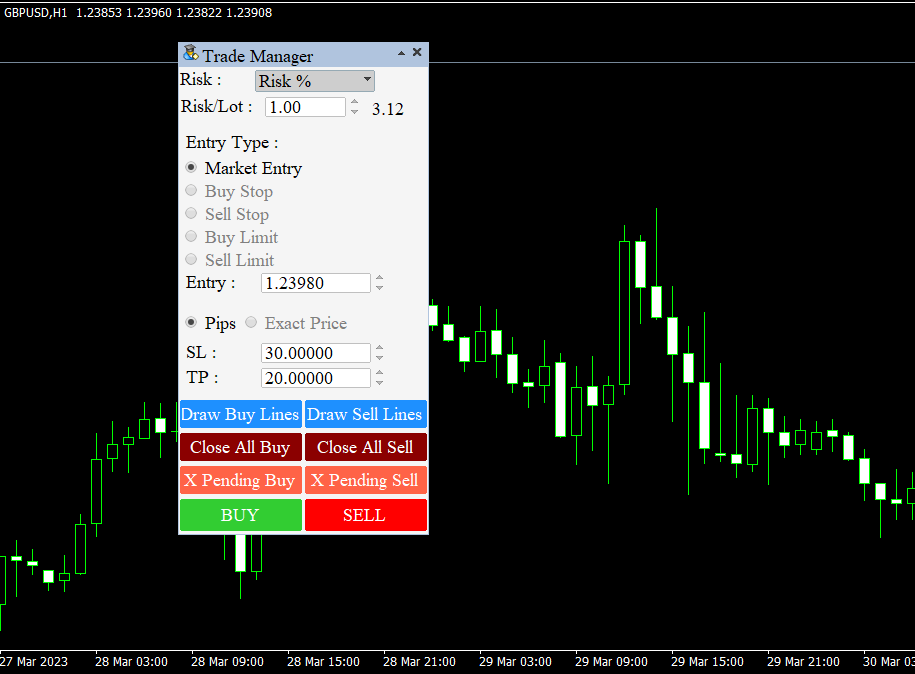

7. Integration with Trading Platforms: Trade Managers are typically integrated with popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). This integration allows traders to execute orders directly from the Trade Manager interface.

8. Customization: Traders can often customize their Trade Managers to suit their specific trading preferences and strategies. This may include setting different risk levels, choosing specific criteria for trailing stops, and more.

9. Trade Reporting: Some Trade Managers offer comprehensive reporting features that provide traders with insights into their trading performance over time.

A MT4 Trade Manager in forex trading is a valuable tool or feature that assists traders in efficiently managing their trades, controlling risk, and optimizing their trading strategies. It simplifies the process of executing and monitoring trades, ultimately helping traders make more informed decisions and potentially improve their trading outcomes.

Trade Management with MetaTrader 4 Expert Advisors:

In the fast-paced world of forex trading, the ability to automate trade-related tasks can be a game-changer. MetaTrader 4 (MT4) offers a powerful tool for achieving this automation: Expert Advisors (EAs). In this section, we’ll delve into how EAs can serve as effective Trade Managers, streamlining the trading process and offering traders a range of benefits.

Automating Trade Entry and Exit:

Automated Trade Entry:

EAs can be programmed to monitor the market for specific conditions or setups that align with a trader’s strategy. When these conditions are met, the EA can automatically enter a trade, ensuring that traders do not miss out on potential opportunities, especially in a rapidly moving market.

Precision in Trade Exit:

EAs are adept at managing trade exits as well. They can apply predefined take-profit and stop-loss levels to trades. When the market reaches these levels, the EA executes the exit orders swiftly and without hesitation. This precision in trade exit is crucial for risk management and capital preservation.

Risk Management Strategies:

Position Sizing:

EAs can calculate position sizes based on a trader’s risk parameters, such as a percentage of account equity or a fixed dollar amount. This automated position sizing ensures that each trade is appropriately sized to align with the trader’s risk tolerance and overall risk management strategy.

Trailing Stops:

Trailing stops are a valuable risk management tool, and EAs excel in implementing them. A trailing stop adjusts the stop-loss level as the trade moves in the trader’s favor, allowing them to lock in profits while giving the trade room to breathe. EAs can manage trailing stops automatically, eliminating the need for constant manual adjustments.

MetaTrader 4 Expert Advisors are powerful tools that offer traders the convenience of automated trade management. They excel at automating trade entry, exit, and risk management strategies, providing precision and efficiency. Traders can rely on EAs to receive real-time alerts and updates, making them an indispensable part of an efficient and streamlined trading operation.

Leveraging 4xPip Resources:

4xPip is not just a website; it’s a valuable resource hub that can significantly enhance a trader’s forex trading experience. In this section, we will delve into how traders can leverage the diverse range of trading tools, bots, and indicators available on 4xPip, and how these resources seamlessly integrate with the popular MetaTrader 4 (MT4) platform.

Enhancing Your Trading Experience:

A One-Stop Solution:

4xPip serves as a one-stop solution for traders seeking to augment their trading strategies and profitability. Whether you’re a novice trader looking to get started or an experienced trader seeking additional tools, 4xPip has something to offer.

Comprehensive Educational Resources:

Traders can access a wealth of educational materials and resources on 4xPip. These resources include articles, tutorials, webinars, and video content designed to improve trading skills and knowledge. It’s an excellent place to sharpen your trading edge.

The Variety of Trading Tools:

Trading Bots:

4xPip offers a variety of trading bots designed to automate trading strategies. These bots can execute trades, manage positions, and implement risk management rules on behalf of traders. This automation can help traders seize opportunities in the fast-paced forex market.

Custom Indicators:

Indicators are essential for technical analysis, and 4xPip provides a selection of custom indicators that can be integrated into the MetaTrader 4 platform. These indicators can assist traders in making more informed trading decisions based on technical signals.

Seamless Integration with MetaTrader 4:

MT4 Compatibility:

One of the standout features of 4xPip is its compatibility with MetaTrader 4. Traders can easily integrate the tools, bots, and indicators from 4xPip into their MT4 platform. This integration ensures a smooth and efficient trading experience without the need for complex setup processes.

Enhancing MT4’s Capabilities:

By leveraging 4xPip resources within Trade Manager MT4 EA, traders can enhance the capabilities of the platform. Whether it’s automating trade execution with a trading bot or using custom indicators for technical analysis, 4xPip adds versatility to the already robust MT4 platform.

Its compatibility with MetaTrader 4 simplifies the integration process, making it easy for traders to access and implement these resources. Whether you’re a beginner or an experienced trader, 4xPip provides the means to elevate your forex trading game and stay competitive in this dynamic market.

Conclusion:

In a constantly evolving forex market, where opportunities and risks abound, a Trade Manager equipped with MetaTrader 4 and complemented by 4xPip resources empowers traders to make informed decisions, manage their trades effectively, and potentially secure good profits. It’s a winning combination that caters to the needs of both novice and experienced traders. Remember, in the world of forex trading, where markets never sleep and opportunities are ever-present, a well-equipped trader with a reliable Trade Manager is better positioned to navigate the complexities of the market and achieve trading success.