Axial Flow Impeller Pumps Market Size, Share, Analysis, Trends, Growth Report, 2030

Axial Flow Impeller Pumps Industry Prospective:

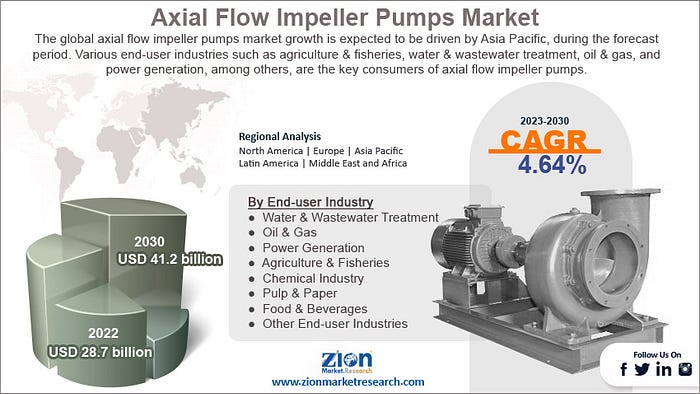

The global axial flow impeller pumps market size was worth around USD 28.7 billion in 2022 and is predicted to grow to around USD 41.2 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.64% between 2023 and 2030.

Axial Flow Impeller Pumps Market: Overview

Axial flow impeller pumps are a type of centrifugal pumps, which are used to move fluid axially through an impeller. In these pumps, the fluid enters & leaves the pump in the direction parallel to the impeller. Axial flow pumps are a velocity pump that enhances pressure or flow velocity at the pump impeller to provide energy to the fluid. These pumps can be driven by both fuel or electric motors. Compared to conventional centrifugal pumps such as radial pumps, axial flow impeller pumps offer better efficiency or pump more fluids with a low delivery head.

Axial flow impeller pumps are used in various industries such as water treatment, irrigation, chemical processing, oil & gas industry, and others. The technological development in the axial flow impeller pump industry is creating new applications and improving the efficiency of the existing pumps. The demand for axial flow impeller pumps is increasing in major global regions such as Asia Pacific, North America, Europe, and others.

Key Insights

- As per the analysis shared by our research analyst, the global axial flow impeller pumps market is estimated to grow annually at a CAGR of around 4.64% over the forecast period (2023–2030).

- In terms of revenue, the global axial flow impeller pumps market size was valued at around USD 28.7 billion in 2022 and is projected to reach USD 41.2 billion, by 2030.

- The global axial flow impeller pumps market is projected to grow at a significant rate due to the increasing demand from the water & wastewater treatment industry.

- Based on type segmentation, horizontal were predicted to show maximum market share in the year 2022.

- Based on pressure segmentation, low pressure was the leading revenue generator in 2022.

- Based on stage segmentation, single-stage was predicted to show maximum market share in the year 2022.

- Based on end-user industry segmentation, agriculture & fisheries were the leading revenue-generating end-user industry in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Axial Flow Impeller Pumps Market: Growth Drivers

Increasing demand from the water & wastewater treatment industry to drive market growth during the forecast period.

The global axial flow impeller pumps market is projected to grow owing to the increasing usage from the water & wastewater treatment industry. In the water treatment industry, axial flow impeller pumps are used to drive or pump water at different stages of treatment. These pumps are used to circulate fluids in sewage digesters. In this industry, axial flow impeller pumps handle significantly large amounts of fluid flow within a treatment plant.

The rising development of water & wastewater treatment infrastructure, across the globe, is fueling the growth of the axial flow impeller pump industry. According to the United Nations, around 58% of global domestic wastewater was safely treated in 2022. Specifically, in Australia & New Zealand, around 92% of domestic wastewater was safely treated in 2022. Moreover, around 86% of domestic wastewater was safely treated in North America & Europe in 2022. However, less than 25% is treated safely in Sub-Saharan Africa and Central & Southern Asia. These factors favor the need for infrastructural development for wastewater treatment, which is expected to support the demand for the axial flow impeller pump industry.

In October 2022, the European Union (EU) Commission submitted a proposal for a New Urban Waste Water Directive by making revisions to the 1991 Waste Water Directive which is expected to improve the treatment of urban wastewater and protect the environment in a more innovative and technologically advanced way.

As of February 2023, Emschergenossenschaft is constructing new wastewater pumping stations in different parts of Germany, including, Bottrop, Gelsenkirchen, and Oberhausen. Further, in March 2023, the European Bank for Reconstruction and Development (EBRD) announced a deal with the Ministry of Planning and International Cooperation to channel European Union (EU) grants of EUR 30 million and help Jordan’s Water Authority to modernize and enhance the water & wastewater management industry in Jordan. The new wastewater treatment facility is likely to have a capacity of around 22.5 thousand cubic meters per day.

In April 2023, Saudi Arabia announced 5 (five) Independent Sewage Treatment Plant (ISTP) projects in Hadda, Uranah, South Najran, Abu Arish, and North Jeddah & 1 Small Sewage Treatment Plant (SSTP) in Northern Province.

Axial Flow Impeller Pumps Market: Restraints

Disadvantages associated with control of highly viscous fluids & low head offerings to restrict market expansion

Axial flow impeller pumps are not preferred for pumping liquids with high viscosity, as they generate low-head & high capacities. High viscous liquid enhances skin friction loss in the blade flow passage, which will further cause a pressure drop & input power loss. Positive displacement pumps such as gear pumps are used for pumping highly viscous fluids. Moreover, axial flow impeller pumps are not suitable for applications that require a high head. High-head pumps are used in sectors such as oil & gas, mining, etc. For high-head applications, various industries select radial centrifugal pumps for their applications.

Axial Flow Impeller Pumps Market: Opportunities

Rising technological development to provide growth opportunities

Rising technological development in the axial flow impeller pump industry is expected to act as an opportunity in the coming years. Various researchers have published their studies on axial flow impeller pump performance in different parameters & segments. Recently, axial flow pump performance for large cavitation tunnel operation was studied. Moreover, researchers have also studied for performance improvement of saddle zone of axial flow pumps using double inlet nozzle.

Specifically, when the axial pump operates in the saddle zone, noises & vibrations are produced, which decreases the efficiency of the axial flow impeller pumps. Moreover, major axial flow impeller firms such as Flowserve Corporation, Pentair, etc. are heavily investing in research & development (R&D) to enhance their product portfolio. For instance, the aggregate cost of R&D for Flowserve Corporation in 2022 accounted for around USD 39.9 million, witnessing a growth rate of around 16.6% compared to the previous year. All such factors are expected to support the industry’s growth for axial flow impeller pumps in the coming years.

Axial Flow Impeller Pumps Market: Challenges

Availability of substitutes to challenge market cap growth

Axial flow impeller pumps can be replaced by a wide range of alternative pumps such as radial flow pumps, semi-axial flow pumps, vortex pumps, and others. A radial flow pump is also a type of centrifugal pump, which displaces the pumped liquid in the radial direction. These pumps are widely used for lift irrigation, power plant applications, water treatment purposes, and others. However, similar performance & efficiency can’t be achieved in certain applications such as low head & high flow rate applications.

Axial Flow Impeller Pumps Market: Segmentation

The global axial flow impeller pumps market is segmented based on type, pressure, stage, end-user industry, and region.

Based on type, the global market segments are horizontal & vertical. Currently, the global market is dominated by horizontal axial flow impeller pumps, considering their high performance in different applications such as irrigation, water treatment, and others.

Based on pressure, the axial flow impeller pumps industry is segmented into low-pressure & high-pressure. The low-pressure segment dominated the market share in 2022. Low-pressure & high-flow rate pumps are widely preferred by various end-user industries.

Based on stage, the global market segments are single-stage & multi-stage. Currently, the global market is dominated by single-stage. Single-stage axial pumps have one impeller, whereas multi-stage impellers have two or more than two impellers around the rotating shaft. Multi-stage axial impeller pumps are used in applications requiring high heads.

Based on the end-user industry, the global axial flow impeller pumps market segments are water & wastewater treatment, oil & gas, power generation, agriculture & fisheries, chemical industry, pulp & paper, food & beverages, and other end-user industries. Currently, the axial flow impeller pumps industry is dominated by the agriculture & fisheries segment. Axial flow impeller pumps are frequently used for irrigation purposes to transfer a large volume of water from a water source, such as a river or reservoir, to crop fields. In fisheries, these pumps are used for drainage & filling applications for fish-water ponds. For instance, according to The World Bank Group, the value added from the global agriculture, forestry, and fishing industry accounted for USD 4.35 trillion in 2022, witnessing a growth rate of around 4.3% compared to the previous year, thereby, supporting the demand for axial flow impeller pumps from respective applications.

Axial Flow Impeller Pumps Market: Report Scope

Report AttributesReport DetailsReport NameAxial Flow Impeller Pumps MarketMarket Size in 2022USD 28.7 BillionMarket Forecast in 2030USD 41.2 BillionGrowth RateCAGR of 4.64%Number of Pages213Key Companies CoveredC.R.I. Pumps Private Limited, CELEROS FLOW TECHNOLOGY, DMW CORPORATION, EBARA CORPORATION, Flowserve Corporation, Franklin Electric, Grundfos Holding A/S, ITT INC. (GOULDS PUMPS), Jiangsu Feiyue Machine And Pumps Group Co. Ltd., KSB SE & Co. KGaA, LEO PUMP, Liancheng Group, Paterson Pumps, Patterson Pump Company (A Gorman-Rupp Company), Pentair, Ruhrpumpen Group (Corporación EG), Shanghai Pacific Pump Manufacture (Group) Co. Ltd, Sichuan Zigong Industrial Pump Co. Ltd, SLB, Sulzer Ltd, The Weir Group PLC, Xylem., and others.Segments CoveredBy Type, By Pressure, By Stage, By End-user Industry, and By RegionRegions CoveredNorth America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA)Base Year2022Historical Year2017 to 2021Forecast Year2023–2030Customization ScopeAvail customized purchase options to meet your exact research needs. Request For Customization

Axial Flow Impeller Pumps Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

The global axial flow impeller pumps market growth is expected to be driven by Asia Pacific, during the forecast period. Various end-user industries such as agriculture & fisheries, water & wastewater treatment, oil & gas, and power generation, among others, are the key consumers of axial flow impeller pumps. According to the Economic and Social Commission for Asia and the Pacific (ESCAP), the agriculture industry in the Central Asia region consumes around 90% of available surface water resources.

For surface water irrigation systems, axial flow impeller pumps are widely used, as these systems require low head & high flow rates of water. As per the Economic Cooperation and Development (OECD) & Food and Agriculture Organization (FAO), the global crop is majorly sourced from China (30%), India (17%), and the rest of the Asia Pacific region (14%). In addition, according to The World Bank Group, the value added from the agriculture, forestry, and fishing industries in China accounted for USD 1.31 trillion in 2022, witnessing a growth rate of around 1.5% compared to the previous year.

Axial flow impeller pumps are widely used in water & wastewater treatment. According to the International Trade Administration (United States), water treatment plants in China treat wastewater for around 28% of rural areas and 98% of municipalities.

In India, according to the Central Pollution Control Board (India), there is huge potential for the development of wastewater infrastructure. The country has the potential to treat & reuse around 80% of the wastewater generated. The treated water can be used for various non-potable purposes. The urban region of the country generates around 72,000 million liters (MLD) of sewage every day and only 28% is treated & reused. In July 2023, IDE Technologies announced that CleanEdge Water Pte Ltd. awarded a contract to the company to provide a wastewater treatment plant (WWTP) for a mining sector in Rajasthan, India. The plant will have the capacity to treat around 4.0 million liters of brine per day. The project is expected to be completed by 2024.

According to the Energy Institute (EI), oil production in the Asia-Pacific region accounted for around 7.27 million barrels per day, registering a decline rate of around 1.36% compared to the previous year.

In Asia Pacific, China is among the key processors of oil & gas. According to the National Bureau of Statistics of China, around 675.9 million tons of crude oil were processed in 2022, a decline of around 3.4% year-on-year (Y-o-Y).

Huge volumes of axial flow impeller pumps are procured, during the production cycle, in the form of replacement of the previous one. According to the Ministry of Economy, Trade and Industry, METI (Japan), the production volume of crude oil in Japan accounted for around 420.78 million liters in 2022, registering a decline of around 14.1%, over the previous year, thereby, negatively impacting the growth of axial flow impeller pump industry.

In addition, North America is among the key consumers of axial flow impeller pumps for its well-developed oil & gas and agriculture industry. According to the Energy Information Administration (EIA), the production volume of crude oil in the United States increased by 5.6% to around 11.9 million barrels per day (b/d) in 2022. Further, according to the United States Department of Agriculture (USDA), the total number of farms in the United States accounted for around 2 million units in 2022. All such factors are likely to support the demand for axial flow impeller pumps from respective end-user industries in North America.

Axial Flow Impeller Pumps Market: Competitive Analysis

The global axial flow impeller pumps market is dominated by players like:

- C.R.I. Pumps Private Limited

- CELEROS FLOW TECHNOLOGY

- DMW CORPORATION

- EBARA CORPORATION

- Flowserve Corporation

- Franklin Electric

- Grundfos Holding A/S

- ITT INC. (GOULDS PUMPS)

- Jiangsu Feiyue Machine And Pumps Group Co., Ltd.

- KSB SE & Co. KGaA

- LEO PUMP

- Liancheng Group

- Paterson Pumps

- Patterson Pump Company (A Gorman-Rupp Company)

- Pentair

- Ruhrpumpen Group (Corporación EG)

- Shanghai Pacific Pump Manufacture (Group) Co., Ltd

- Sichuan Zigong Industrial Pump Co., Ltd

- SLB

- Sulzer Ltd

- The Weir Group PLC

- Xylem

The global axial flow impeller pumps market is segmented as follows:

By Type

- Horizontal

- Vertical

By Pressure

- Low Pressure

- High Pressure

By Stage

- Single-stage

- Multi-stage

By End-user Industry

- Water & Wastewater Treatment

- Oil & Gas

- Power Generation

- Agriculture & Fisheries

- Chemical Industry

- Pulp & Paper

- Food & Beverages

- Other End-user Industries

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa